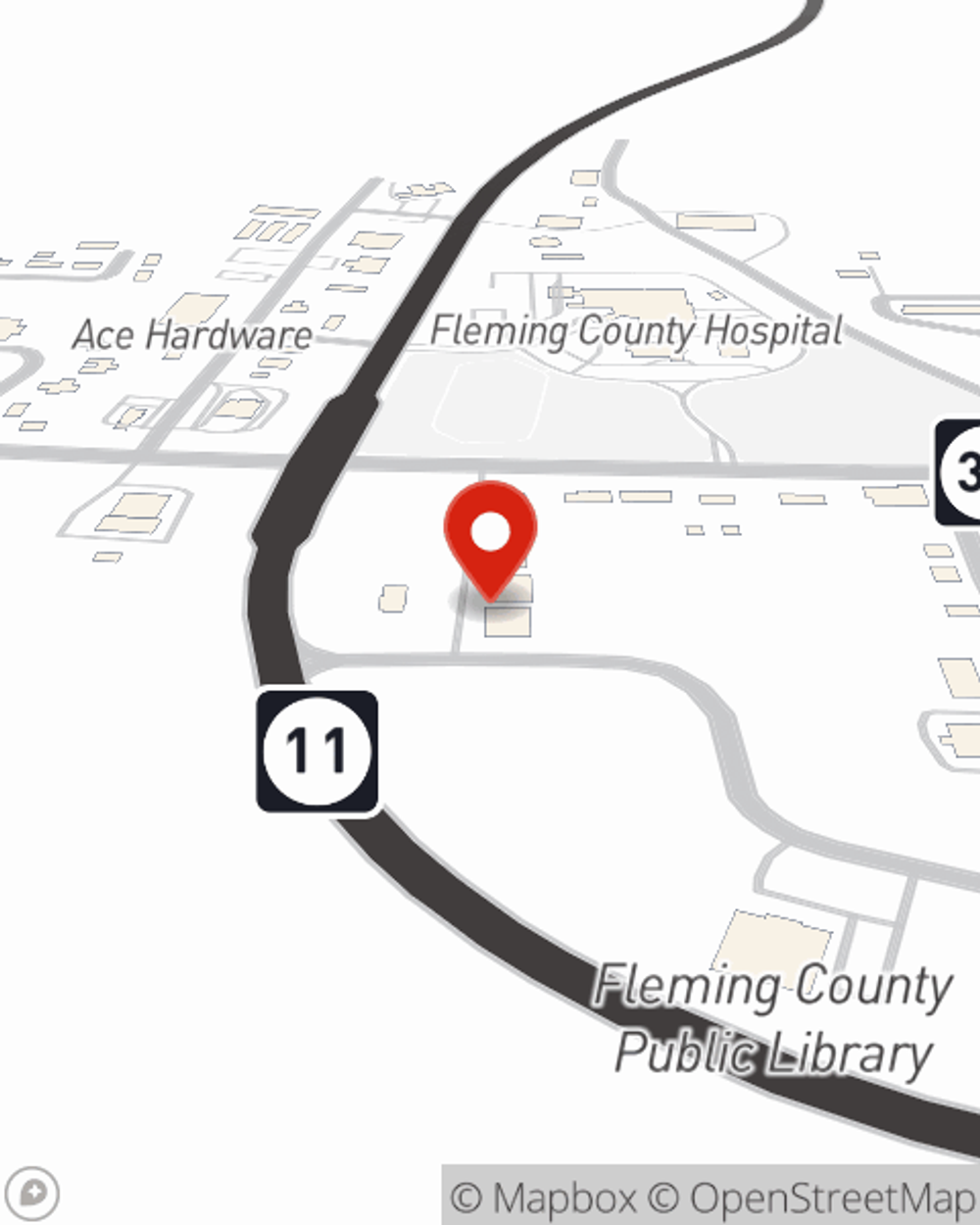

Business Insurance in and around Flemingsburg

Flemingsburg! Look no further for small business insurance.

Cover all the bases for your small business

- Flemingsburg

- Fleming County

- Maysville Kentucky

- Mason County

- Tollesboro

- Winchester

- Mount Sterling

- Morehead

State Farm Understands Small Businesses.

Being a business owner isn't easy. You want to make sure your business and everyone connected to it are covered in the event of some unexpected loss or trouble. And you also want to care for any staff and customers who become injured on your property.

Flemingsburg! Look no further for small business insurance.

Cover all the bases for your small business

Customizable Coverage For Your Business

Being a business owner requires plenty of planning. Since even your most detailed plans can't predict natural disasters or consumer demand. In business, you can be certain of one thing: nothing is certain. That’s why it makes good sense to plan for the unexpected with a State Farm small business policy. Business insurance covers your business from all kinds of mishaps and troubles.. It protects your hard work with coverage like errors and omissions liability and extra liability. Terrific coverage like this is why Flemingsburg business owners choose State Farm insurance. State Farm agent Bethany Hicks can help design a policy for the level of coverage you have in mind. If troubles find you, Bethany Hicks can be there to help you file your claim and help your business life go right again.

Do what's right for your business, your employees, and your customers by reaching out to State Farm agent Bethany Hicks today to explore your business insurance options!

Simple Insights®

Employer-owned life insurance

Employer-owned life insurance

Find out about employer-owned life insurance policies and how they might play a vital role in the financial life of a business.

The landlord's guide to the eviction process

The landlord's guide to the eviction process

Evictions can be a lengthy, daunting process for landlords and tenants, so it’s important for you to be aware of the specific reasons, procedures and costs.

Bethany Hicks

State Farm® Insurance AgentSimple Insights®

Employer-owned life insurance

Employer-owned life insurance

Find out about employer-owned life insurance policies and how they might play a vital role in the financial life of a business.

The landlord's guide to the eviction process

The landlord's guide to the eviction process

Evictions can be a lengthy, daunting process for landlords and tenants, so it’s important for you to be aware of the specific reasons, procedures and costs.